General News

8 July, 2021

Profits before people

WESTPAC Bank reported earlier this year $3.4 billion profit for the first half of their financial year. In 2020 the bank reported $2.3 billion in profit for the full year. There appears to be good money in banking.

Peter Williams (name has been changed to protect his identity), from Cairns is disgusted at the tactics employed by Westpac to ensure they profits and maximised and customer needs are ignored.

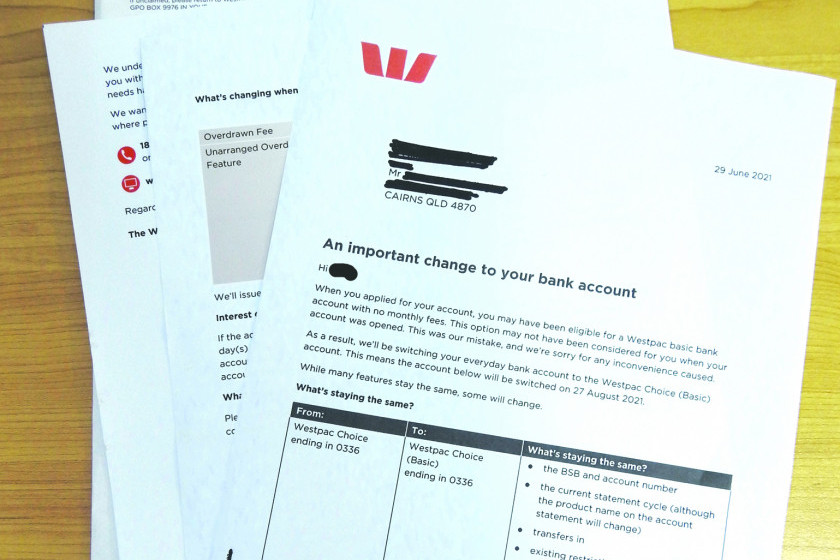

On Monday this week, Mr Williams received a letter from Westpac advising of important changes to his Westpac Choice account, opened 8 years ago.

The account was opened to allow access to a debit mastercard, for online purchasing using funds in the account.

The balance was always small, and purchases were minimal, but the convenience of having the account was what suited.

What Williams was unaware of, because the Westpac staff member who assisted with the opening of the account did not reveal, there was a cheaper option available at the time, an option that waived the monthly $5 account keeping fee.

This cheaper option was only realised after the letter was received from Westpac advising and apologising for not making this option available.

“When you applied for your account, you may have been eligible for a Westpac basic bank account with no monthly fees.

This option may not have been considered for you when your account was opened. This is our mistake, and we’re sorry for any inconvenience caused.”

The letter then went onto inform Williams that his account would be automatically switched to the Basic account on August 27, with no change to features, except no monthly account keeping fees.

Upon receiving his letter, Williams contacted Westpac via their call centre and was put through to a specialist dealing with this matter.

The operator confirmed the planned changes and also confirmed the new account would not attract the $5 monthly account keeping fee.

Apparently the $5 monthly fee could have been waived if Williams deposited total of $2000 in the calendar month. That’s not maintaining $2000 balance that’s adding $2000 to the account each month.

“I was told it was a mistake, I should have been eligible for a zero-monthly account-keeping fee account.

“What burns me is their statement in their letter to me, ‘this option may have not been considered FOR me.’

“Their staff member was either wilfully maximising their profits, or the staff member did not have full product knowledge regarding their accounts and options.

“Either way it is a sad indictment upon Westpac. They either have or had a culture of profits before people or they have had very poor staff training,” he said.

“Imagine the figures, if they have 100,000 of these such accounts, each month that’s half a million dollars in bank fees for absolutely not cost to them. Is it any wonder they are making billions.”

Although Westpac have admitted their mistake in the letter to Williams, there is no offer of recompense for fees collected during the past eight years.

“Why would they bother sending a letter admitting fault and not offer to refund the account fees associated. It’s arrogant to say the very least.”

Westpac were contacted regarding this matter. Cairns Local News requested information as to the number of account holders that were affected by this failure to presents the no-fees option account along with whether there would be a refund paid to account holders.

Westpac responded to our request and a Westpac spokesperson can confirm the following.

“We regularly review our products and services, and during this process we identified some customers may have been eligible for an alternate bank account. These customers are being moved to a basic bank account and we will put things right by making sure they are not left out of pocket as a result of this error.”